Summary of the Enacted 2020-21 Budget: Impact on California’s Older Adults, People with Disabilities, and Family Caregivers

summary

On June 29, 2020, California Governor Gavin Newsom signed California’s 2020-21 budget. The budget addresses the $54.3 billion deficit while maintaining funding for critical programs serving older adults, people with disabilities, and family caregivers.

Date Updated: 07/09/2020On June 29, 2020, California Governor Gavin Newsom signed California’s 2020-21 budget. The budget addresses the $54.3 billion deficit while maintaining funding for critical programs serving older adults, people with disabilities, and family caregivers.

Overview

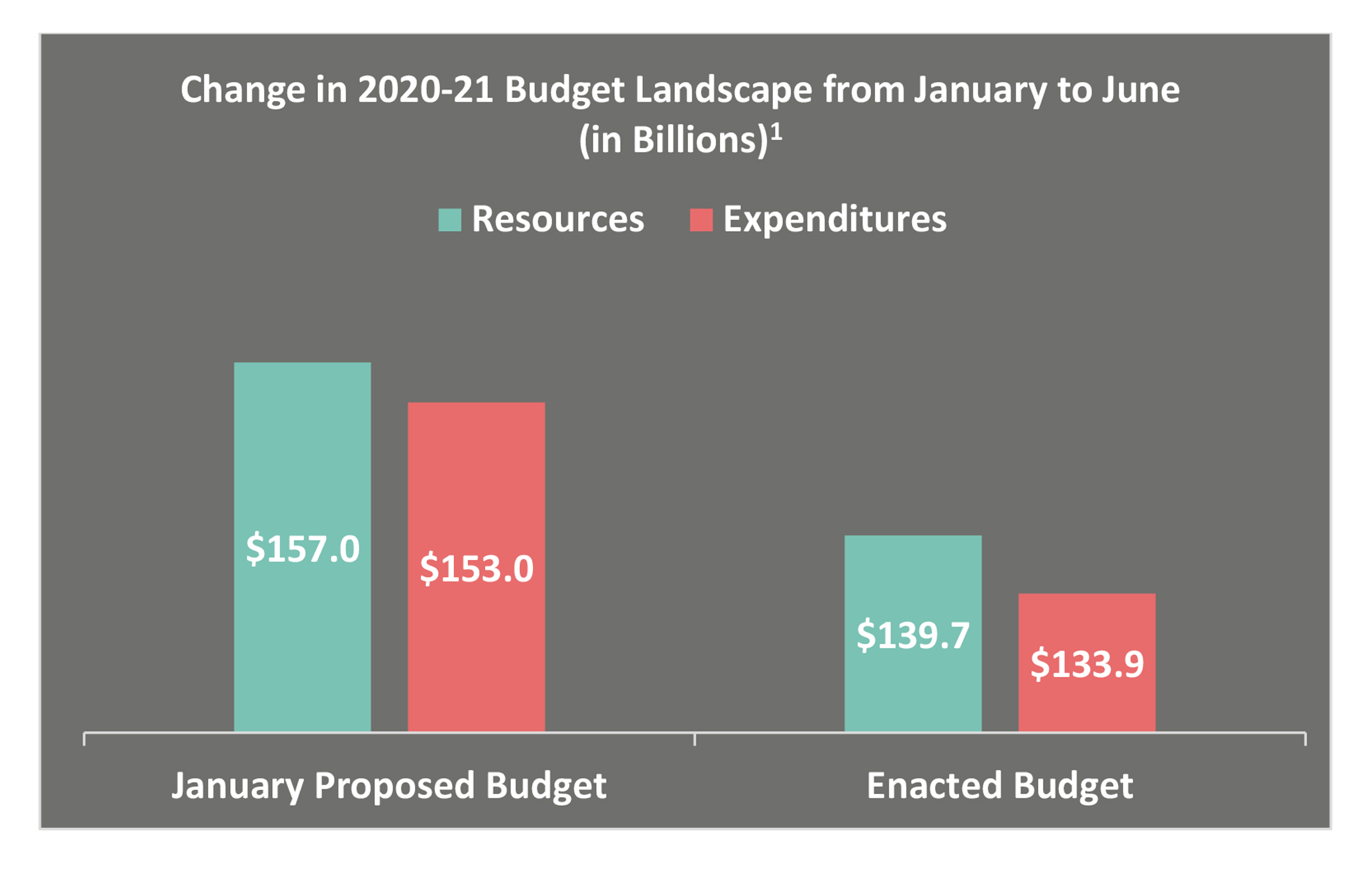

On June 29, 2020, Governor Gavin Newsom signed the 2020-21 budget, addressing the $54.3 billion deficit brought on by the coronavirus (COVID-19) crisis. The enacted budget rejected a number of proposed cuts outlined in the May Revision, including those impacting older adults, people with disabilities, and caregivers.1 Additionally, Governor Newsom issued a budget emergency proclamation on June 25, making additional funds available through the state’s rainy day fund.2 Overall, the budget reflects total General Fund (GF) resources of $139.7 billion and anticipated expenditures of $133.9 billion.1

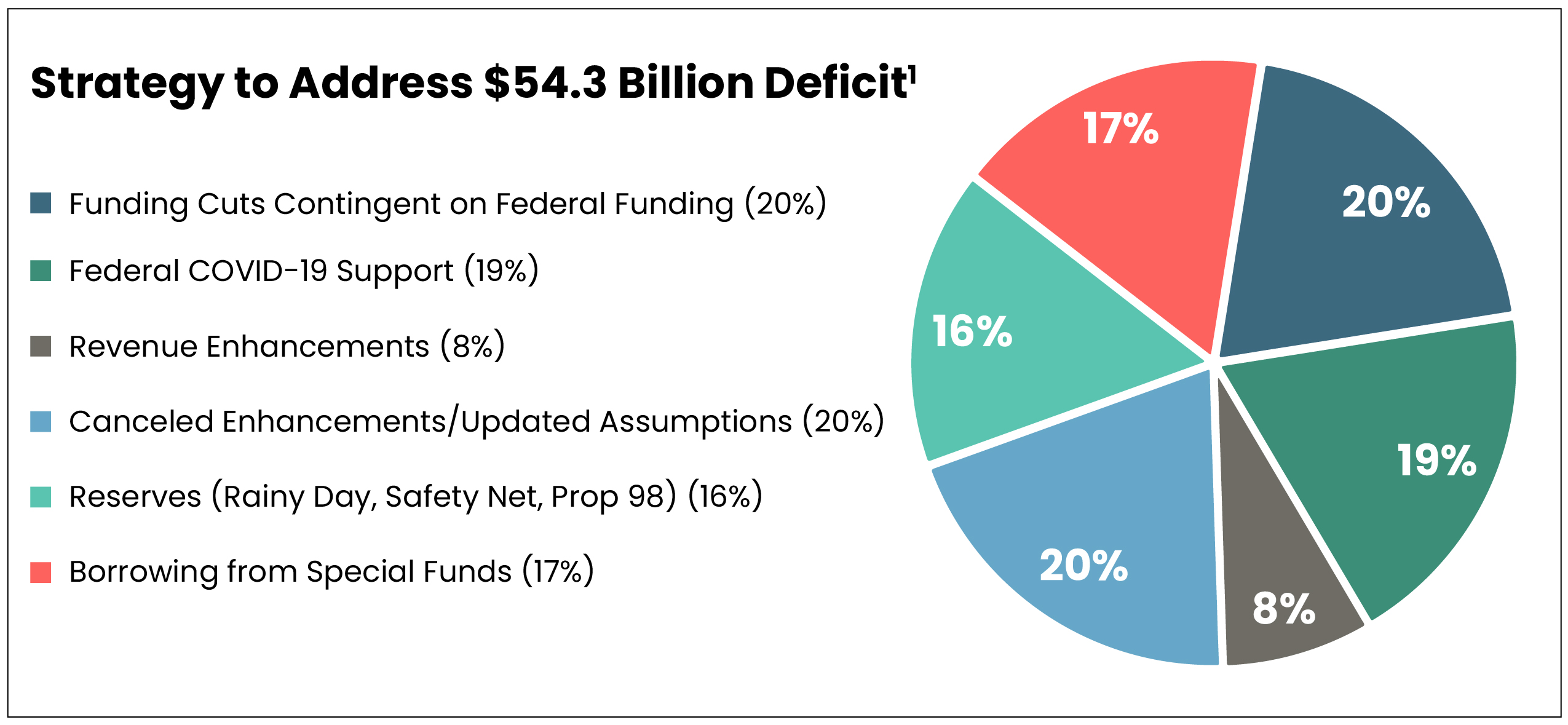

The enacted budget used a range of approaches to close the deficit, including program reduction, use of state reserves and federal funding for COVID-19 relief and withdrawal of several proposals in the January budget. The enacted budget includes $11.1 billion in reductions and deferrals that will be restored if at least $14 billion in federal funds are received by October 15, 2020. The triggered reductions and deferrals included funding for education, state employee compensation, courts, moderate-income housing, and more.1

In the May Revision, the governor proposed eliminating the Community-Based Adult Services (CBAS) and Multipurpose Senior Services Program (MSSP), along with cuts to In-Home Supportive Services (IHSS), certain Medi-Cal optional benefits, and Proposition 56 provider rate increases. The Legislature disagreed, and worked out an agreement with the governor to preserve funding in the 2020-21 budget for these and other critical programs serving and supporting older adults, people with disabilities, and their caregivers.1

In normal budget years, state tax collection is completed April 15, prior to the enactment of the budget. The governor uses the May Revision to adjust the state spending plan to reflect actual tax receipts. During the COVID-19 crisis, the tax deadline was extended to July 15. While it is unlikely that any major changes will be made to this budget agreement, there is a possibility that state leaders may want to discuss budget adjustments in August to reflect the actual tax revenue collected. It is also possible that Congress and the president will act on the next COVID-19 relief bill by the end of July to provide a basis for further state budget discussions.

Looking forward, the deficit for 2021-22 is forecasted at $8.7 billion, which presents a continued threat in future budget years to fund programs that serve older adults, people with disabilities, and their caregivers.1 Responding to the threat of future deficits, the budget maintains the January 1, 2022, suspension of several ongoing programmatic expansions established in the 2019 Budget Act. This includes specified Medi-Cal optional benefits, such as audiology, speech therapy, optometry services, and podiatry. In addition, the budget moves the suspension timeline of most Proposition 56 Medi-Cal program rate increases up to July 1, 2021. These suspensions will be lifted if it is determined that there is sufficient General Fund revenue to support these programs in the subsequent two years.

While the enacted budget rejected proposed cuts to critical programs serving older adults, people with disabilities, and family caregivers, the risk of budget deficits in following years could still pose a threat to future funding for these programs.

Enacted Budget Items Impacting Older Adults, People with Disabilities, and Family Caregivers

The following tables outline program funding in the enacted budget as compared to the May Revision proposals. Tables 1-2 outline proposed reductions to home- and community-based services that were rejected with funding included in the enacted budget. Tables 3-4 reflect proposals that were upheld in the enacted budget, resulting in funding cuts. Table 5 shows the proposed investment in skilled nursing facilities in the May Revision that was upheld.

| Table 1: Proposed May Revision Funding Cuts Rejected as Part of the Enacted Budget1,3-7 | |||

| Program & Number of Californians Affected (Where Data Is Available) |

May Revision Proposal | Enacted Budget | |

| Proposed Action | Estimated Reduction | Final Action | |

| Community-Based Adults Services (CBAS)

Affects 36,679 Californians8 |

Eliminate CBAS program as of July 1, 2020. |

$108.4 million GF* | Maintains funding, rejects May Revision. |

| Multipurpose Senior Services Program (MSSP)

Affects 9,283 Californians9 |

Eliminate MSSP program as of July 1, 2020. |

$22.2 million GF | Maintains funding, rejects May Revision. |

| Medi-Cal Eligibility Expansion for Age, Blind, and Disabled to 138 percent FPL

Affects 30,000 Californians10 |

Eliminate expansion of Medi-Cal for older adults and people with disabilities with incomes between 123 percent and 138 percent of the federal poverty level (FPL). |

$135.5 million ($67.7 million GF) |

Maintains funding, rejects May Revision. |

| Medi-Cal Estate Recovery | Reinstate estate recovery policy that collects against all medical care incurred. | $16.9 million GF | Rejects May Revision. |

| Supplemental Security Income/State Supplementary Payment (SSI/SSP) Grants

Affects 1.2 million Californians11 |

Reduce the state’s SSP grant by the amount of the federal January 2021 cost of living adjustment for the SSI portion of the grant. | $33.6 million GF | Rejects May Revision. |

| Senior Nutrition Program

Affects 212,725 Californians12,13 |

Reduce funding increase for congregate and home-delivered meal programs included in the 2019 Budget Act. |

$8.5 million GF | Maintains funding, rejects May Revision. |

| Caregiver Resource Centers

Affects 18,000 California families14 |

Eliminate funding increase for the Caregiver Resource Centers included in the 2019 Budget Act. |

$10 million GF | Maintains funding, rejects May Revision. |

| Aging and Disability Resource Centers (ADRC) | Reduce funding to partially offset the $4.2 million increase authorized under the 2019 Budget Act. | $3 million GF | Maintains funding, rejects May Revision. |

| Independent Living Centers (ILC) | Reduce funding for ILCs. | $2.1 million GF | Maintains funding, rejects May Revision. |

| LTC Ombudsman Program | Reduce funding for LTC Ombudsman Program. | $2 million GF | Maintains funding, rejects May Revision. |

| Table 2: Proposed May Revise Funding Cuts Rejected for 2020-21 Budget – with Future Funding Suspended Under Specified Conditions 1,3-6 | |||

| Program & Number of Californians Affected (Where Data is Available) |

May Revision Proposal | Enacted Budget | |

| Proposed Action | Estimated Reduction | Final Action | |

| In-Home Supportive Services (IHSS)

Affects 625,180 Californians |

Apply a 7 percent reduction in the number of hours provided to IHSS beneficiaries as of January 1, 2021. |

$205 million GF | Maintains funding, rejects May Revision. Under specified conditions, suspends funds December 31, 2021.† |

| Optional Medi-Cal Benefits | Eliminate: audiology; incontinence creams and washes; speech, occupational, and physical therapy; optician/optical lab; podiatry; acupuncture; optometry; nurse anesthetist services; pharmacist services; drug screening, intervention, and treatment referrals; and diabetes prevention program services. Reduce adult dental services. | $54.7 million GF | Maintains funding, rejects May Revision. Under specified conditions, suspends funds for certain optional benefits December 31, 2021.† |

| Proposition 56: Provider Payments | Eliminate Proposition 56 supplemental payments for physician, dental, and family health services; developmental screenings; non-emergency medical transportation; value-based payments; and loan repayments for physicians and dentists to support growth in the Medi-Cal program. |

$1.1 billion | Maintains funding, rejects May Revision. Under specified conditions, suspends funds July 1, 2021.† |

| Table 3: Funding Cuts Included in the Enacted Budget1,3-6 | |||

| Program & Number of Californians Affected (Where Data is Available) | May Revision Proposal | Enacted Budget | |

| Proposed Action | Estimated Reduction | Final Action | |

| In-Home Supportive Services (IHSS)

Affects 625,180 Californians |

Freeze IHSS county administration funding at 2019-20 level. | $12.2 million GF | Eliminates funding, upholds May Revision. |

| California Advancing and Innovating Medi-Cal (CalAIM) | Delay implementation of the CalAIM initiative. | $347.5 million GF | $347.5 million GF |

| California Access to Housing and Services Fund | Eliminate proposed funding to establish a fund for developing affordable housing units, supplementing and augmenting rental subsidies, and stabilizing board and care homes. | $750 million GF | Eliminates funding, upholds May Revision. |

| Health Insurance Counseling and Advocacy Program (HICAP) | Loan from the HICAP fund to GF. | $5 million | Borrows $5 million in HICAP funds, with intent to restore in future years. |

| Table 4: New Proposals from January Suspended or Eliminated3,6 | |||

| Program | May Revision Proposal | Enacted Budget | |

| Proposed Action | Estimated Reduction | Final Action | |

| Medi-Cal for Undocumented Older Adults | Rescind proposal to expand Medi-Cal to undocumented older adults. | $112.7 million ($87 million GF) |

Delays implementation to January 1, 2022. |

| California Cognitive Care Coordination Initiative | Eliminate one-time funds and withdraws proposal. | $3.6 million GF | Eliminates funding, upholds May Revision. |

| Table 5: Approved Investment1,3 | |||

| Program | May Revision Proposal | Enacted Budget | |

| Proposed Action | Estimated Investment | Final Action | |

| Skilled Nursing Facilities | Increase rates by 10 percent for four months to support COVID-19 response during pandemic. | $72.4 million GF (2019-20)$41.6 million GF (2020-21) |

Includes 10 percent rate increase, upholds May Revision. |

Download the publication for all visuals and complete references.

Continue Reading

This policy brief provides an introduction to The SCAN Foundation’s CLASS Technical Assistance Brief Series, which explores many of the critical issues to be considered for successfully implementing CLASS.

This policy brief describes the broad needs of individuals with disability and the wide range of supportive and environmental solutions that can allow for the most independent living possible. It suggests how findings on social and environmental supports for individuals with disability can inform implementation of CLASS.

This policy brief provides background on the historical development of benefit eligibility triggers in the private long-term care insurance market. Understanding how these triggers came into being can provide important information to those charged with implementing the CLASS Plan.