May Revision of the Proposed 2021-22 Budget: Impact on California’s Older Adults, People With Disabilities, and Family Caregivers

summary

On May 14, 2021, California Governor Gavin Newsom released the May Revision of the 2021-22 proposed budget. The revision includes a $75.7 billion surplus with investments in economic recovery related to COVID-19 and resources to implement the Master Plan for Aging.

Date Updated: 06/01/2021On May 14, 2021, California Governor Gavin Newsom released the May Revision of the 2021-22 proposed budget. The revision assumes a $75.7 billion surplus with investments in economic recovery related to COVID-19 and resources to implement the Master Plan for Aging.

Overview

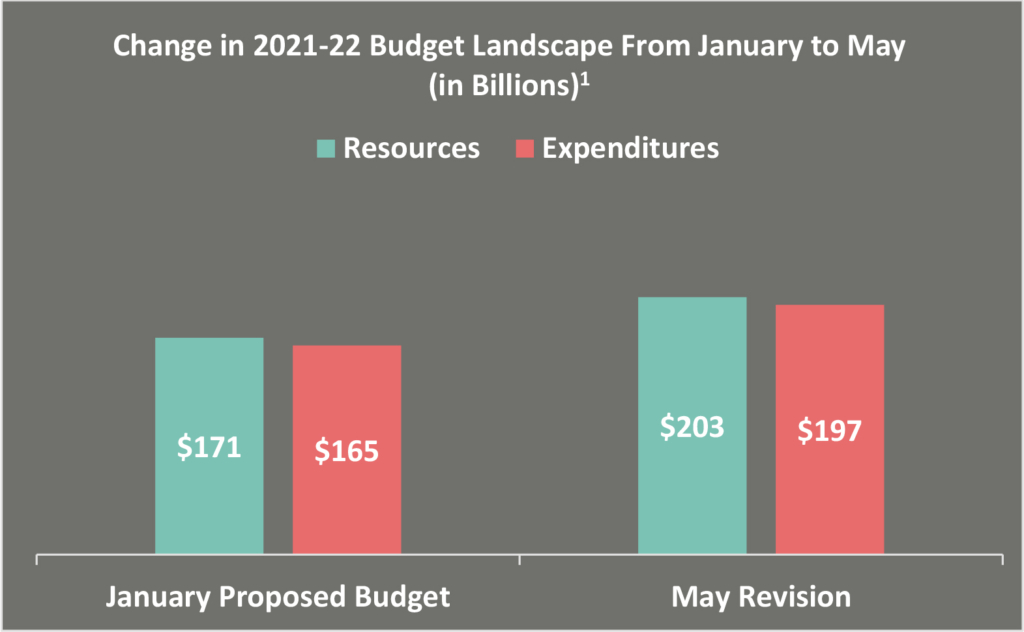

On May 14, 2021, Governor Gavin Newsom released an updated budget forecast for the 2021-22 budget, referred to as the “May Revision.” Due to federal relief and better-than-anticipated revenue, the governor assumes in the revision a $75.7 billion surplus, in contrast to the projected budget deficit of $54 billion at this time last year. In response to this budget surplus, the governor invested in economic recovery related to COVID-19, long-term investments to strengthen infrastructure, as well as resources to implement the Master Plan for Aging.1

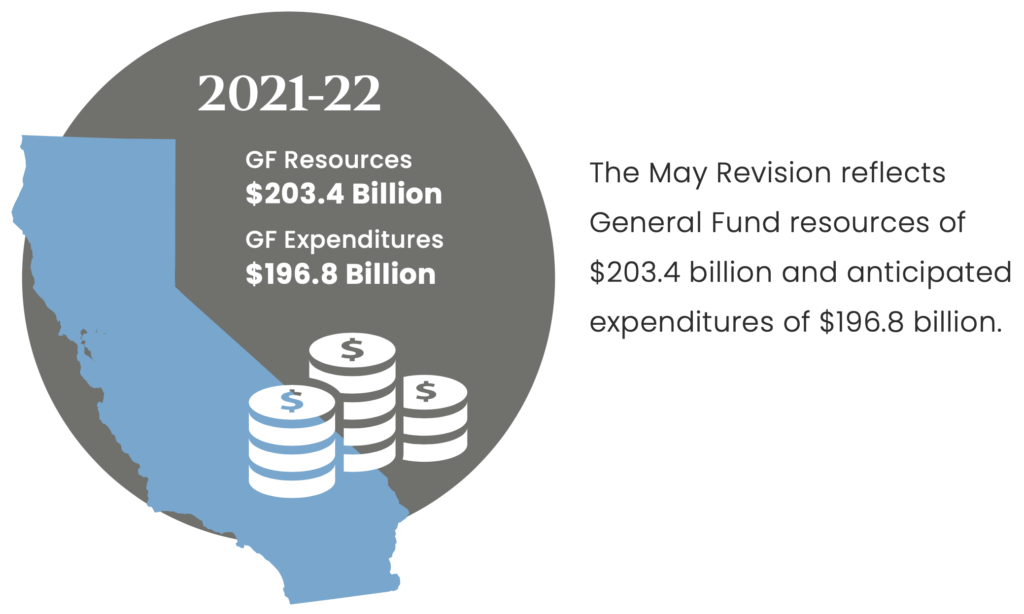

The May Revision includes total General Fund (GF) resources of $203.4 billion and anticipated expenditures of $196.8 billion, with the rest held in reserve. The proposed budget reflects a Budget Stabilization Account* balance of $15.9 billion, a Safety Net Reserve† balance of $450 million, and plans to address the state’s pension liabilities.1

Federal Update: American Rescue Plan Act

On March 11, 2021, President Biden signed the American Rescue Plan Act of 2021 (ARP), which included $350 billion to state and local governments for fiscal recovery. California is expected to receive about $27 billion of those funds.3 The ARP also included a temporary 10 percent increase to the Federal Medical Assistance Percentage (FMAP) to states for certain Medicaid home- and community-based services. The Centers for Medicare and Medicaid Services published guidance for the expenditure of these funds around the same time California’s May Revision was released. As such, further policy and budgetary changes will occur as Governor Newsom and the California Legislature work to finalize the 2021-22 state budget later this month.

Background on Aging, Alzheimer’s, and Equity Investments

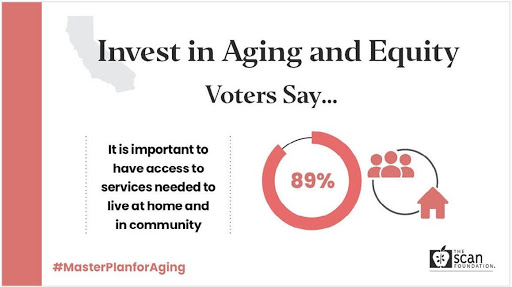

On January 6, 2021, Governor Newsom released the Master Plan for Aging (Master Plan), a ten-year blueprint for public and private entities at the state, regional, and local levels to address system challenges and transform services across housing, transportation, health care, and long-term services and supports, among other areas. As COVID-19 continues to disproportionately affect older adults and people with disabilities—especially in Black, Latinx, Indigenous, and Asian and Pacific Islander communities—the importance of infrastructure investment to support California’s diverse aging population becomes increasingly apparent. A recent poll shows strong support for the Master Plan with aging, equity, and Alzheimer’s policies as top priorities for California voters.

Rooted in principles of equity, the May Revision builds off the governor’s proposed budget, expanding investment in Master Plan implementation and addressing the system-wide needs and challenges that impact California’s diverse aging and disabled populations.

Budget Proposals Impacting Older Adults and People With Disabilities

The May Revision includes new investments that impact California’s older adults and people with disabilities while maintaining funding for established programs and services. Several investments are supported by the use of one-time funds and continued COVID-19 stimulus funding, all of which advance Master Plan implementation.1

| Senior Advisor on Aging, Disability, and Alzheimer’s | Commitment to establish a position within the governor’s office to lead on cross-cabinet initiatives and cross-sector partnerships | No amount listed | No change |

| Office of Medicare Innovation and Integration | Establishes this new office inside the Department of Health Care Services (DHCS) to focus on policy opportunities related to Medicare-only and dual-eligible populations | $602,000 ($452,000 GF) |

|

| Master Plan leadership/ operations | Funds 20 permanent positions within the California Department of Aging (CDA) for implementation of the Master Plan | $5 million GF | $3.3 million GF |

| Health information exchange | Calls on the California Health and Human Services Agency (CHHS) to lead information exchange efforts for health and social services | $2.5 million GF± |

The May Revision proposes new one-time General Fund investment of $106 million to CDA to be used over three years in an effort to address the isolation and health impacts of COVID-19 on older adults. This investment is intended to help older adults re-engage with in-person community activities and services, through the network of services provided by local Area Agencies on Aging.1,4 Table 2 provides a breakdown of the $106 million investment by program.

| Table 2: Older Adult Recovery and Resiliency1,4,5 | ||

| Program | Proposal (New in May 2021) | 2021-22 May Revision |

| Behavioral health warmline | Allows for expansion and enhancement of the behavioral health warmline services, including language access | $2.1 million GF± |

| Digital connections | Provides additional funds to the Connections, Health, Aging and Technology (CHAT) program to continue to help address the digital divide | $17 million GF± |

| Elder and disability abuse prevention | Establishes a new council to ensure elder and disability abuse prevention activities are coordinated across key departments (i.e., California Departments of Aging, Social Services, and Justice) | $1 million GF± |

| Legal services | Expands legal services to assist older adults and people with disabilities | $20 million GF± |

| Employment opportunities | Allows CDA to open all slots in the Senior Community Service Employment Program, funding all participants at California’s minimum wage level | $17 million GF± |

| Home-delivered and community center meals | Allows CDA to serve more older adults home-delivered and congregate meals | $20.7 million GF± |

| Fall prevention and home modifications | Increases funds for the Dignity at Home Fall Prevention program to provide education, training, and home modifications to more older adults | $10 million GF± |

| Family caregiving services | Provides additional funds for supportive services to unpaid family caregivers | $2.8 million GF± |

| Aging and Disability Resource Connection | Provides additional funds in support of ADRCs and development of a statewide call center and website | $9.4 million GF± |

| State and local leadership and oversight | Funds the state and local operations necessary to administer and oversee these programs and new investments | $6 million GF± |

The May Revision includes efforts to analyze data to inform responses for future emergencies, and improve language access across departments and programs in the CHHS agency, as reflected in Table 3.

| Pandemic response review | CHHS to conduct an analysis of the intersection of COVID-19, health disparities, and health equity to help inform any future response | $1.7 million GF | $3 million |

| Language access initiative | Establishes an initiative to improve and deliver language access services across CHHS programs | $20 million GF± |

The May Revision includes investments to support expansion of the Aging and Disability Resource Connection (ADRC) statewide, serving as a “No Wrong Door” approach to connecting people to services. Table 4 reflects investments in ADRC grants and staffing to support the advancement of ADRCs, a cornerstone of the Master Plan.

| Local assistance | Expands the ADRC program statewide and develops a statewide portal | $7.5 million GF | $7.5 million GF (2021-22) . $10 million GF (ongoing) |

| State operations | Funds 13 permanent positions to support the ADRC program | $2 million GF |

The May Revision includes investments to expand access to coordinated health care and long-term services and supports (LTSS). Investments include funds to move forward with California Advancing and Innovating Medi-Cal (CalAIM) and a commitment for DHCS to establish rates for audio-only telehealth. The May Revision also ends the practice of automatic funding suspensions for certain programs in future years.1 Table 5 highlights these changes and critical investments in health care and LTSS.

| Medi-Cal expansion | Expands Medi-Cal to about 27,000 undocumented adults age 60 and older by May 1, 2022 | $69 million ($50 million GF) . $1 billion ($859 million GF) ongoing |

|

| Medi-Cal optional benefits | Repeals the suspension of Medi-Cal optional benefits such as audiology and speech therapy services, incontinence creams and washes, optician/optical lab services, and podiatric services | $47 million ($15.6 million GF) |

No amount listed |

| California Advancing and Innovating Medi-Cal (CalAIM) |

Implements CalAIM beginning January 1, 2022. The investment includes:

|

$1.1 billion ($531.9 million GF) |

No change |

| Telehealth | Expands and makes permanent certain telehealth COVID-19 flexibilities, and adds remote patient monitoring services as a Medi-Cal covered benefit | $94.8 million ($34 million GF) |

No change |

| Population Health Management Service | Creates a centralized data system of administrative and clinical data from DHCS, health plans, and providers | $315 million ($31.5 million GF)± |

|

| Medically tailored meals | Continues provision of medically tailored meals until an option for

In-Lieu of Services under CalAIM |

$9.3 million GF± | |

| Geriatric workforce | Grows and diversifies the geriatric medicine workforce | $3 million GF± | $8 million GF± |

| Community-Based Adult Services (CBAS) | Provides 10 permanent positions in CDA for CBAS certification | $1.9 million ($773,000 GF) . $2.4 million ($946,000 GF) ongoing |

|

| In-Home Supportive Services (IHSS) | Makes permanent the IHSS back-up provider system to avoid caregiving disruptions due to emergencies | $5.3 million GF± | $11.1 million GF± |

| IHSS base funding | Increases IHSS funding over the revised 2020-21 level | $16.5 billion ($5.3 billion GF) |

$17.2 billion ($5.5 billion GF) |

| IHSS state/county funding ratio | Maintains the state/county ratio for non- federal costs of 65/35 amid increases in minimum wage | $57.3 million GF | |

| IHSS – elimination of 7% reduction | Eliminates the across-the-board 7% reduction in service hours | $449.8 million GF | $248 million GF (2021-22) . $496 million GF (ongoing) |

| Long-Term Care Career Pathways | Incentivizes and funds career paths for IHSS providers | $200 million GF± | |

| Health Insurance Counseling and Advocacy Program (HICAP) | Modernizes HICAP | $2 million HICAP Fund through 2022-23 . $2.5 million (2021-22) |

|

| Office of Long-Term Care (LTC) Patient Representative | Establishes the LTC Office of Patient Representative within CDA | $4 million (ongoing) Licensing and Certification Program Fund |

The May Revision includes a comprehensive package of services to address Alzheimer’s disease, including $7.5 million in new investments in addition to the $17 million in the governor’s proposed budget.1 Table 6 highlights these investments, reflecting the differences between the proposed budget and May Revision.

| Alzheimer’s disease provider training | Expands health care provider training and standards of care on Alzheimer’s disease | $2 million GF± | $4.5 million GF± |

| Alzheimer’s disease research | Addresses disparities and promotes equity in Alzheimer’s disease research | $4 million GF± | No change |

| Alzheimer’s disease brain health campaign | Launches a public education campaign on brain health | $5 million GF± | $10 million GF± |

| Alzheimer’s disease caregiver training | Provides caregiver training and certification in Alzheimer’s disease | $4 million GF± | No change |

| Dementia-friendly communities | Provides grants to help communities become dementia-friendly | $2 million GF± | No change |

The May Revision prioritizes access to affordable housing, as well as services for those experiencing homelessness, with new investments supported by a combination of federal and state dollars. Investments in housing grants, loans, tax credits, property acquisitions, and supportive services increased from $8 billion in the governor’s proposed budget to $9.3 billion in the May Revision. Investments in housing supports and services to local jurisdictions for the homeless population increased from $2.1 billion in the governor’s proposed budget to $6.8 billion in the May Revision.1

Table 7 reflects the housing items that directly impact older adults and people with disabilities.

| Community Care Expansion | Acquires and rehabilitates Adult Residential Facilities and Residential Care Facilities of the Elderly to expand housing for homeless, low-income older adults, or those at risk for homelessness | $250 million GF± | $500 million ($50 million GF)± |

| Accessory dwelling units | Expands available funding for accessory dwelling units | $81 million± | |

| Preservation of affordable housing | Allows the state to preserve existing affordable housing units as affordability covenants expire | $300 million± | |

| Housing and Disability Advocacy Program | Assists older adults and people with disabilities experiencing homelessness | $175 million GF | |

| HomeSafe | Provides health, safety, and housing supports for older and vulnerable adults involved in or at risk of involvement in Adult Protect Services | $25 million GF | $100 million GF |

| Supportive services for formerly homeless veterans | Supports aging veterans and veterans with disabilities who have experienced chronic homelessness | $25 million GF | |

| Project Homekey | Provides Project Homekey grants to local public entities to convert underused properties to housing for the homeless | $750 million GF± | $3.5 billion± (over 2 years) |

| Project Roomkey transitions | Supports transitioning Project Roomkey program participants into permanent housing | $150 million GF |

The May Revision invests in economic security and food access initiatives to assist California’s low-income older adults and people with disabilities in obtaining income support and food assistance, as outlined in Table 8.

| Supplemental Security Income/ State Supplemental Payment (SSI/SSP) | In 2021, maximum SSI/SSP grant levels are $955 per month for individuals and $1,598 per month for couples, and are projected to increase by $17 and $26 respectively as of January 2022 | $2.7 billion GF | No change |

| SSP, Cash Assistance Program for Immigrants, and California Veterans Cash Benefit | Restores the cost-of-living adjustment for benefit recipients back to 2011 payment levels | $131.5 million GF | |

| Senior Nutrition | Removes program suspensions to allow local assistance funding for home- delivered and community center meals for older adults | $17.5 million GF | $17.5 million GF |

| CalFresh Expansion – Older Adults Outreach | Assists older adults eligible for SSI and SSP with applying for CalFresh benefits | $2.0 million ($1.1 million GF) |

|

| Food banks | Supports Emergency Food Assistance Program providers, food banks, tribes, and tribal organizations to mitigate increased food needs related to COVID-19 | $30 million GF± | No change |

| Supplemental Nutrition Benefit and Transitional Nutritional Benefit | Adjusts benefit amounts to mitigate the effects of the elimination of the SSI Cash-Out policy | $22.3 million GF | No change |

| California Food Assistance Program Emergency Allotments | Allows households to receive maximum allowable allotment based on household size | $11.4 million GF± | No change |

Next Steps in the Budget Process

Budget subcommittees have reviewed the governor’s May Revision and held hearings through the end of May. Each subcommittee will vote on budget items contained within its respective issue area(s) and submit a report for vote in the full budget committee. Next, the full membership of the Senate and Assembly will vote on the full budget bill. Each chamber’s budget bill will be referred to a joint budget conference committee where differences between the Senate and Assembly versions will be resolved. The Conference Committee then votes on the proposed version, which, if passed, is sent to the floor of the Assembly and Senate simultaneously. By law, the Legislature must approve the budget by June 15. The governor has the authority to “blue pencil” (reduce or eliminate) any appropriation contained in the budget prior to signing it by July 1, 2021.6,7

Download the publication for all visuals and complete references.

Continue Reading

This policy brief provides an introduction to The SCAN Foundation’s CLASS Technical Assistance Brief Series, which explores many of the critical issues to be considered for successfully implementing CLASS.

This policy brief describes the broad needs of individuals with disability and the wide range of supportive and environmental solutions that can allow for the most independent living possible. It suggests how findings on social and environmental supports for individuals with disability can inform implementation of CLASS.

This policy brief provides background on the historical development of benefit eligibility triggers in the private long-term care insurance market. Understanding how these triggers came into being can provide important information to those charged with implementing the CLASS Plan.